Is "MASS IMMIGRATION" causing the housing crisis?

Politicians are saying it, the media is running with it, and your uncle is sharing it on Facebook...

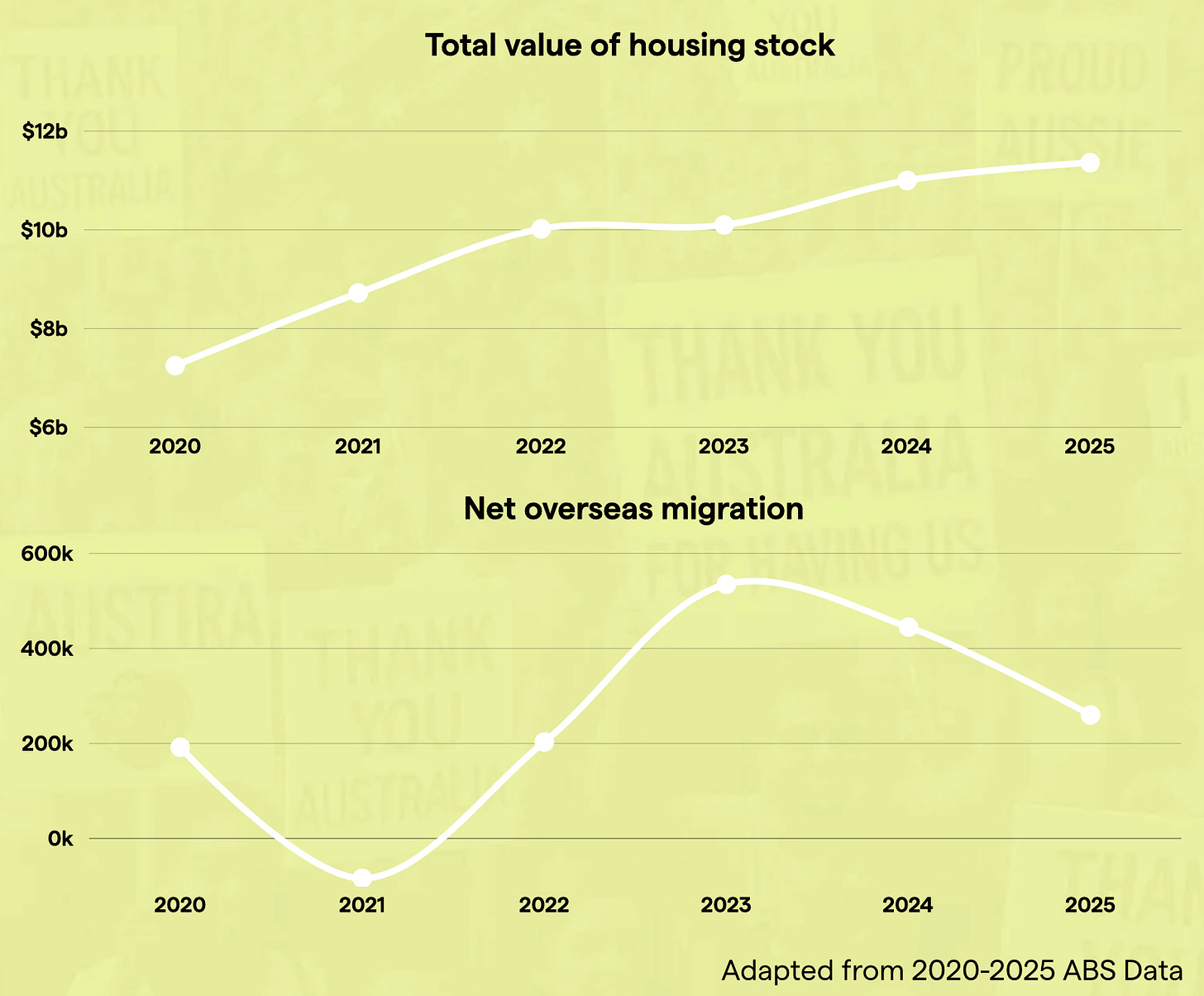

If migration really drove house prices, the two lines would move together.

During COVID, our population shrank by 88,000 people (↓ demand) while construction stayed relatively high (↑ supply). By basic supply and demand logic, homes should have gotten cheaper or at least stabilised. Instead, prices increased by 25%.

Then a few years later, migration hit r…